For the last decade, the increased dominance of the walled gardens, with Google, Meta and Amazon on track to absorb more than 50% of all ad money in 2022, has been a source of contention with many advertisers lamenting the lack of choice afforded to them. While many point to the now ubiquitous technology lumascape (with 7,000+ technology vendors represented), the reality is a contracting marketplace, dominated by just a handful of vendors.

Over recent weeks however, there is mounting evidence to suggest those walls may be slowly coming down, with greater optionality being ushered in through both stealth and design.

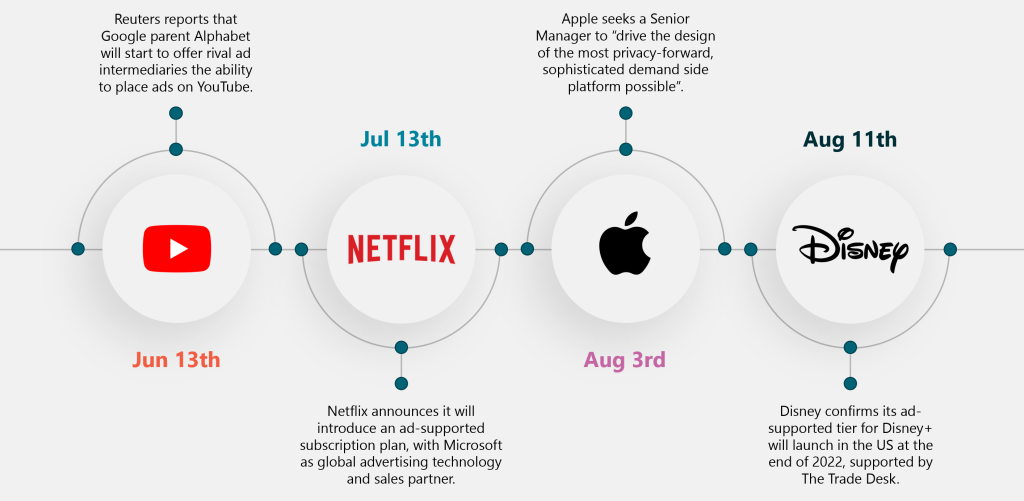

The following developments underline why we may about to see the biggest shift in the industry for several years.

Regulators in the US and EU have argued for years that various areas of Google’s business are anticompetitive, as they seek a more ‘open’ ecosystem. With Disney throwing its weight behind The Trade Desk, and Netflix, a new entrant to advertising in general, selecting Microsoft, it’s clear that the advertising technology landscape will look very different in the near future. So what can we expect to happen?

- Diversification of AdTech

Brands longing for greater optionality in the advertising technology solutions may soon get their wish if reports are true that YouTube will be become accessible to other 3rd party technologies. With much of the concentration of the Google stack driven by YouTube, we may well see rival DSPs utilized as alternative options.

Additionally with Disney and Netflix (and possibly Apple!) following suit, brands will have to accept they could require multiple DSPs to access the different inventory sources.

This is likely to be a fluid topic but as plans become confirmed, expect brands to start to review their ad tech strategies to ensure they remains aligned to strategic (interoperability, inventory access), commercial (fees, data, transparency) & operational (workflow, agility, analytics) needs. - DSP innovation

Greater competition will naturally breed innovation across planning, bid management, optimisation & measurement, helping to unlock for brands improvements to performance and efficiency. Integrated solutions (e.g. Google) will have to continually invest in the development of their platforms to reinforce competitive advantage and differentiation from other 3rd party tools. - Emergence of specialist DSPs

Like with paid search or social advertising, which saw the emergence of dozens of specialist optimisation tools, we could see emerging a similar set of partners offering specialist functionality across the media platforms (YouTube, Netflix, Disney etc). Brands and their agencies will need to keep a watchful eye on innovations in this area and be open to test and learn as new partners become available. - Growing complexity & cost

The simplicity of being able to buy media at scale from a single platform cannot be underestimated. It has ushered in opportunities for automation and naturally created huge operational efficiencies for both brands and agencies. A more diverse technology ecosystem on the other hand will bring with it added complexity and cost, to support the additional management burden required to manage and coordinate multiple platforms. In addition, dividing investment across [potentially] multiple platforms will limit the bargaining power, thereby leading to increased technology fees.

This incremental time and cost will need to be contextualised against potential efficiency or effectiveness improvements if a more diverse approach is to be adopted. - Domino effect?

If Google opens YouTube to third-party tech, regulators and the wider industry might pressure other walled gardens, such as Amazon and Meta, to open their platforms. This could usher in a transformational phase in the industry, with opportunities to disrupt conventional approaches to measurement, audience planning and activation.

If you’d like to discuss any of the topics raised in this article, please speak to: